Several months before the hotel begins operations, sales activities for the hotel should already commence. By starting sales before the hotel opens, the goal is to have guests filling the hotel from the very first day of operation. Subsequently, the occupancy rate can quickly increase over time. Generally, a hotel needs an occupancy rate of around 30% to cover its operational costs. Therefore, for a newly opened hotel, working capital needs to be prepared to cover the shortfall in operational costs during the initial months of operation. The speed at which the occupancy rate increases depend significantly on the comprehensiveness and aggressiveness of the sales program implemented. Generally, it takes between 3 to 6 months for a newly operating hotel to become self-funded.

To maximize hotel sales, all hotel sales channels must be optimally utilized. Below are the sales channels according to their market segments:

- FIT (Free Independent Traveler): Individuals or small groups (less than 5 people) who make their own reservations for independent travel:

- Walk-in

- Direct reservations

- OTA (Online Travel Agent)

- Corporate

- Government

- Travel agent

- Wholesaler

- GIT (Group Inclusive Tour): Groups of more than 5 people with a pre-arranged itinerary and special pricing:

- Government

- Corporate

- Travel agent

- Wholesaler

Every newly operating hotel requires sufficient time to achieve optimal hotel performance. In the long run, the principle of “Don’t put all eggs in one basket” is advisable. Therefore, it’s beneficial for the portfolio of market segments mentioned above to be fully operational.

There is a correlation between hotel performance and the number of accounts registered in the hotel system. Thus, monitoring the growth of hotel accounts regularly allows for analysis and exploration of potential opportunities that can be pursued. Each market segment has its own characteristics and requires different approaches, resulting in varying response speeds from each segment. Normatively, in terms of response speed, the market segments follow this order:

- Online bookings, whether through direct booking (Central Reservation) or OTA (Online Travel Agent)

- Government market

- Travel agents

- Corporate contracts

By applying the right pricing and market penetration strategies for each market segment, optimal hotel performance can be achieved within a relatively short period. Therefore, analyzing existing statistical data from each market segment is crucial to understanding market conditions.

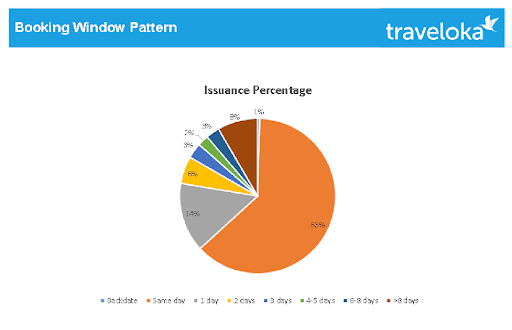

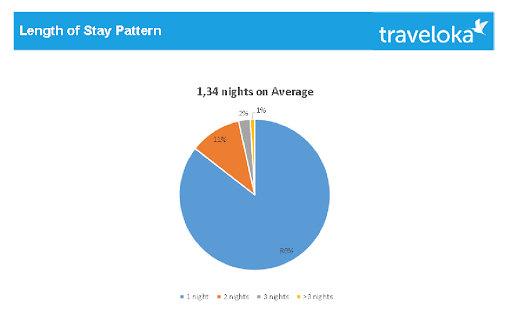

As an example, here are some OTA market segment data from Traveloka for Topotels Hotels & Resorts in the first quarter of 2017. Across 18 hotels in various cities in Indonesia, with nearly 20,000 rooms, the summary is as follows:

From the statistical data, it’s evident that more than 60% of OTA guests book on the same day. Less than 10% of bookings are made more than 5 days in advance.

In terms of length of stay, the majority of OTA guests stay for just one night (over 80%), while those staying more than 3 nights make up only around 11%.

The government market segment is acquired through processes such as tenders or comparisons with competing hotels when a relevant event is to be held by the concerned institution. Hence, the amount of business gained from this market segment is somewhat influenced by the hotel’s ability to win such tenders.

To attract guests from the corporate market segment requires relatively greater effort compared to OTA and government markets. This is because typically, when a hotel starts operating, these companies may already have contracts with established competitor hotels. Therefore, these companies need to be convinced that the newly opened hotel offers advantages over its competitors. However, once the market is established, the corporate segment consists of repeat guests who are loyal, ensuring relatively stable long-term production.